In the fast-paced world of business operations, seamless invoice handling is paramount. However, manual invoice processing often leads to a host of AP challenges that can hinder efficiency and accuracy. This article delves into the five most common hurdles encountered during invoice processing and highlights the pivotal role that AP automation plays in overcoming these obstacles.

Importance of Efficient Accounts Payable

Efficient Accounts Payable (AP) process is the lifeblood of any organization, ensuring timely payments, accurate financial records, and streamlined operations. Yet, manual invoice processing can be labor-intensive, error-prone, and time-consuming, impeding the business’s overall efficiency. This is where automation steps in as a game-changer, offering innovative solutions to revolutionize the invoice processing landscape.

Common Accounts Payable Challenges

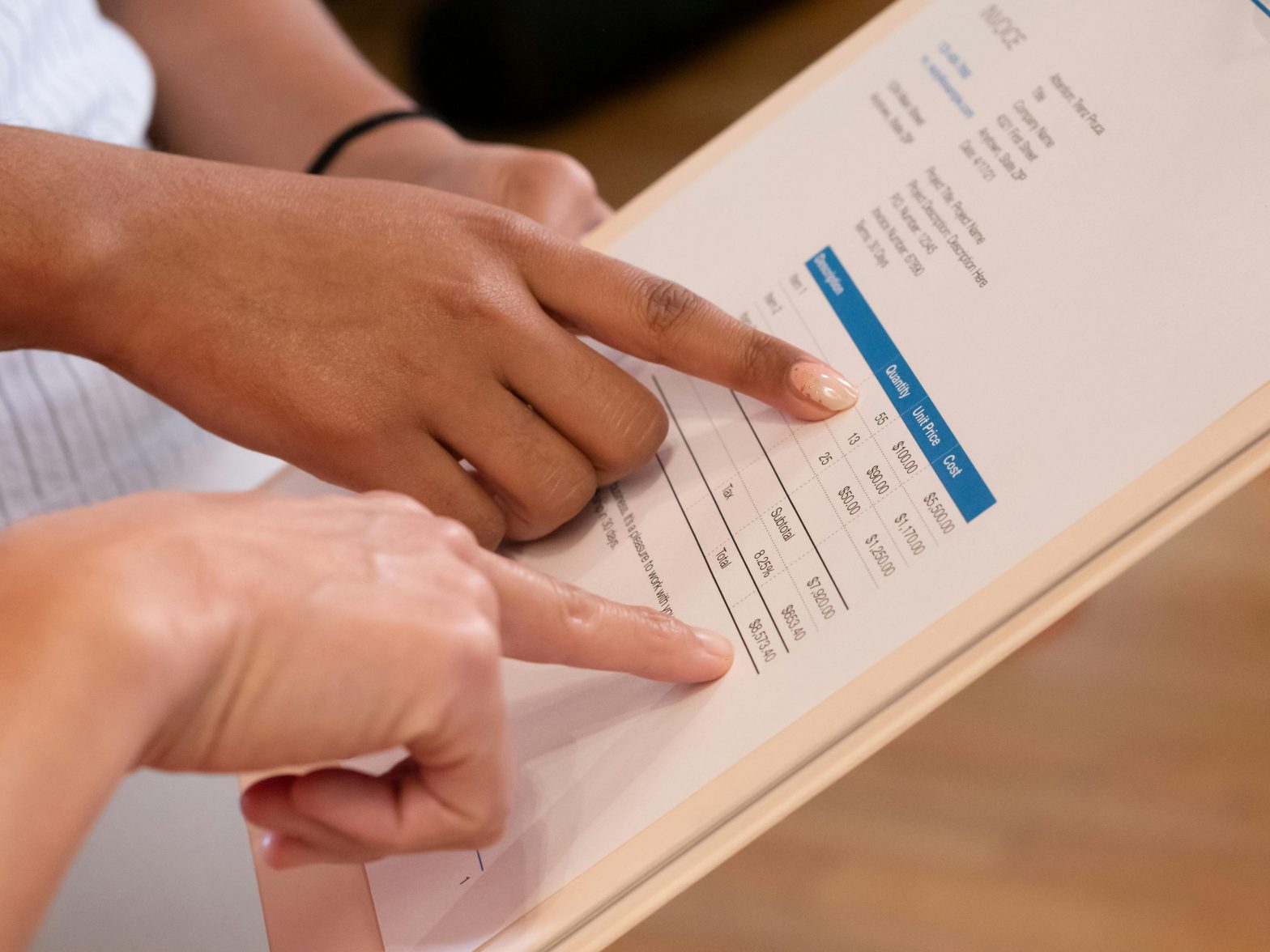

1. Manual Data Entry

One of the primary challenges in invoice processing is the tedious and error-prone nature of manual data entry. Employees spend countless hours inputting data from invoices into the system, increasing the risk of inaccuracies and delays.

2. Errors and Discrepancies

Manual processing leaves room for human errors and discrepancies, such as incorrect data entry, duplicate payments, and mismatched information. These errors can lead to financial losses and damage supplier relationships.

3. Delays in Approval Workflow

Traditional approval workflows often involve manual routing of invoices for review and approval, causing bottlenecks and delays in the process. This can result in late payments, missed discounts, and strained vendor relationships.

4. Lack of Visibility and Control

Without a centralized system in place, businesses struggle to maintain visibility and control over the invoice processing workflow. This lack of transparency can lead to inefficiencies, missed deadlines, and compliance issues.

5. Compliance and Security Risks

Manual invoice processing exposes businesses to compliance risks, such as regulatory violations and data breaches. Without robust security measures in place, sensitive financial information is vulnerable to unauthorized access and fraud.

The Benefits of Implementing AP Automation

1. Time and Cost Savings

Automation streamlines the invoice processing workflow, reducing the time and resources required for manual tasks. By automating repetitive processes, businesses can achieve significant cost savings and allocate resources more strategically.

2. Increased Accuracy and Reduced Errors

Automation eliminates the risk of human errors associated with manual data entry, ensuring accurate and consistent data across all invoices. This enhanced accuracy minimizes the likelihood of payment discrepancies and reconciliation issues.

3. Streamlined Approval Processes

Automation facilitates the seamless routing of invoices for approval, ensuring swift decision-making and eliminating bottlenecks in the workflow. Automated approval workflows enable real-time tracking of invoice status, enhancing transparency and accountability.

4. Enhanced Visibility and Control

Automation provides businesses with a centralized platform for managing invoice processing, offering real-time visibility into the entire workflow. With automated reporting and analytics, organizations can gain valuable insights to optimize processes and make informed decisions.

5. Mitigation of Compliance Risks

By implementing automation solutions, businesses can enforce compliance with regulatory requirements and internal policies. Automated workflows incorporate security features to safeguard sensitive data, reducing the risk of fraud and ensuring data integrity.

Why You Should Choose PF 360 Capture AP Automation Software

PF 360 Capture AP Automation Software stands out as a top choice for businesses seeking to revolutionize their invoice processing workflows. With its advanced document automation capabilities and robust data extraction features, PF 360 simplifies and accelerates the processing of invoices, eliminating manual errors and enhancing accuracy.

The streamlined approval processes and enhanced visibility offered by PF 360 ensure efficient workflow management and compliance with regulatory requirements. By choosing PF 360 Capture, businesses can unlock the full potential of automation, driving operational efficiency, cost savings, and unparalleled control over their invoice processing operations.

Conclusion

In conclusion, the challenges inherent in manual invoice processing can be effectively mitigated through the adoption of automation solutions.

By embracing automation technologies such as document automation, data extraction, and AP automation, businesses can streamline their invoice processing workflows and achieve operational efficiency.

It is imperative for organizations to recognize the transformative impact of automation in overcoming these challenges and to leverage automation tools to optimize their invoice processing operations.